Financial institutions and law enforcement agencies face mounting pressure to detect illicit cryptocurrency activities in real-time. Risk signals serve as the foundation of effective transaction monitoring, transforming raw blockchain data into actionable intelligence that compliance teams can act upon immediately.

Understanding Risk Signals in Crypto Monitoring

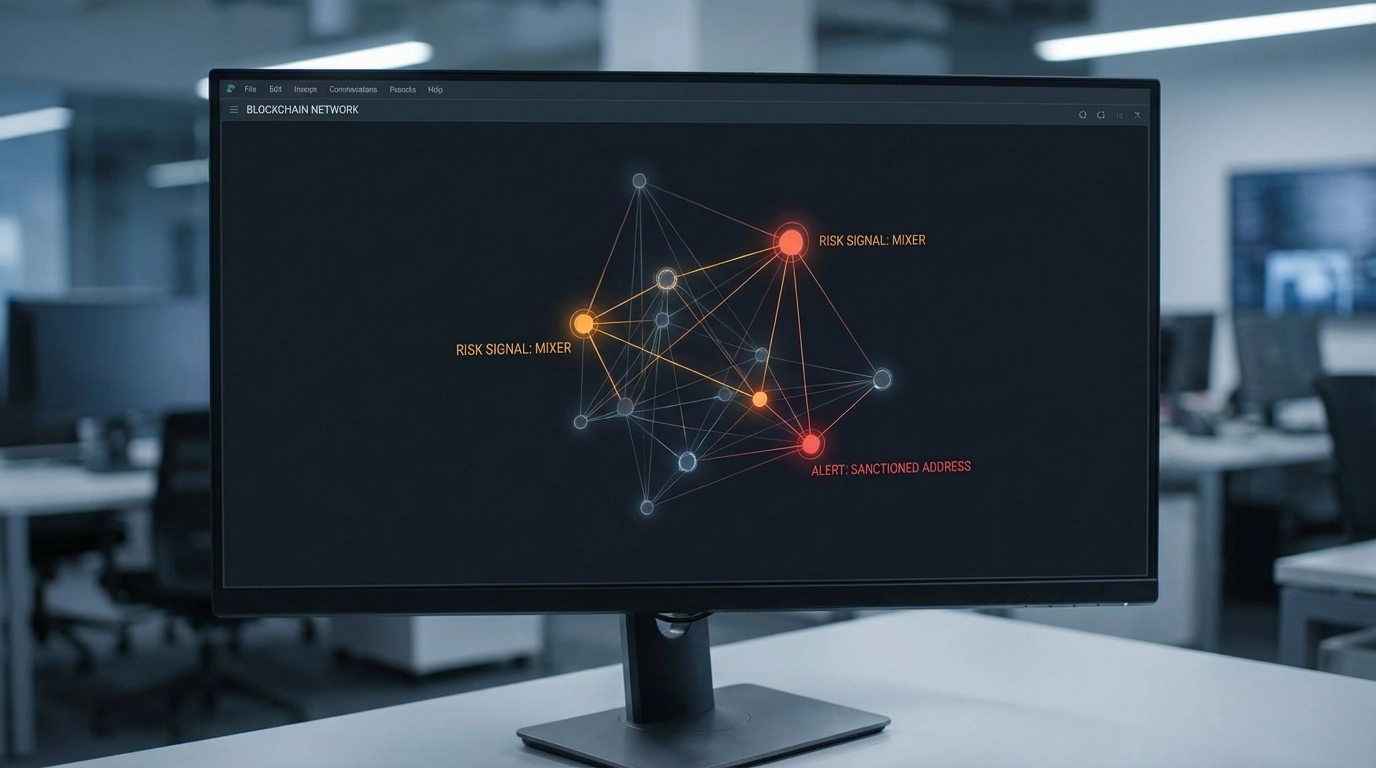

Cryptocurrency risk signals are automated indicators that surface when transaction behavior deviates from expected patterns. In a transaction monitoring crypto program, these signals transform raw on-chain activity into prioritized insights that crypto compliance software can route for analyst review as part of broader AML crypto solutions.

Unlike traditional banking, blockchain analytics must interpret graph structures, wallet histories, timing patterns, and protocol-specific behaviors across multiple networks. Each transaction can carry distinct metadata that needs to be evaluated concurrently for context-rich decisioning.

Typical signal categories include:

- Direct or indirect exposure to sanctioned entities or known high-risk services

- Abnormal velocity, bursty patterns, or unusual sizing relative to historical baselines

- Interaction with wallets that present adverse history or confirmed case associations

- Obfuscation techniques such as hop chains, peel chains, or mixers

- Cross-chain hops and multi-asset movements that complicate attribution

The U.S. Department of the Treasury emphasizes that virtual currency activity requires enhanced monitoring capabilities; robust risk signals help teams focus attention on events that merit human review.

Integration Within Monitoring Workflows

A modern transaction monitoring crypto workflow typically follows a clear operational sequence where risk signals serve as triggers and routing cues:

- Ingest: Stream transactions from multiple blockchains, payment processors, and internal systems in near real time

- Normalize and enrich: Standardize formats, attach entity metadata, tags, and case references

- Evaluate rules: Apply risk parameters and typology rules to generate cryptocurrency risk signals

- Score and route: Combine rules with behavior analytics to rank severity and auto-route to queues

- Escalate: Create cases for higher-severity signals and attach relevant artifacts for investigation

- Document and learn: Capture analyst outcomes to refine rules and models

Risk signals don’t operate in isolation. Correlation across time windows and counterparties reveals composite behaviors—e.g., rapid dispersion plus interaction with obfuscation services—turning weak individual signals into a material pattern that warrants review.

Real-Time Detection and Alert Generation

Effective crypto compliance software requires low-latency processing so high-priority activity can be paused, reviewed, or blocked within operational windows.

Well-governed rule libraries commonly flag patterns such as:

- Structuring-like sequences and unusual velocity relative to account baselines

- Rapid movement across clusters of newly created or low-history wallets

- Interactions with known high-risk services or darknet marketplace addresses

- Exposure to wallets previously associated with ransomware operations

Sensitivity should be tuned to risk appetite and regulatory obligations, with graded severity and queueing that prevents analyst overload while maintaining timely intervention on high-signal events.

The U.S. Department of the Treasury underscores risk-based monitoring principles—configurable thresholds aligned to policy and typologies are essential for an effective program.

Historical Analysis and Retroactive Monitoring

Risk signals enable both prospective and retrospective transaction analysis. When new risk designations are attributed to specific wallet addresses or entities, monitoring systems automatically scan historical blockchain data to identify any previous interactions between those addresses and monitored institutions.

This retroactive capability means that cryptocurrency risk signals aren't limited to real-time transactions. Historical transactions can suddenly become relevant when new intelligence emerges about particular addresses or transaction patterns, allowing compliance teams to identify previously unknown exposures.

Blockchain investigation software maintains comprehensive transaction histories that enable this retroactive analysis. Unlike traditional banking systems where historical data might be archived or difficult to access, blockchain data remains permanently available for reanalysis as new risk intelligence emerges.

Investigation and Case Management Integration

When risk signals trigger alerts, they automatically populate case management systems with relevant transaction details, wallet information, and supporting documentation. This integration ensures that compliance analysts have immediate access to all pertinent information needed for investigation.

Law enforcement cryptocurrency tools often integrate directly with case management platforms, allowing investigators to trace fund flows, validate exposure paths across multiple blockchain hops, and document findings for regulatory reporting. Risk signals provide the initial detection mechanism, while investigation tools enable detailed analysis and evidence gathering.

The integration extends to regulatory reporting requirements, where risk signals help identify transactions requiring Suspicious Activity Report (SAR) filings or other compliance documentation. Automated case creation ensures that detected signals receive appropriate review within required timeframes.

Cross-Chain and Multi-Asset Monitoring

Modern crypto wallet analysis must account for activities across multiple blockchain networks and asset types. Risk signals need to evaluate not just individual transactions but also cross-chain movements, atomic swaps, and multi-asset mixing patterns that span different blockchain ecosystems.

Advanced monitoring systems aggregate risk signals from multiple blockchains to create comprehensive risk profiles for specific addresses or entities. A wallet might appear low-risk on one blockchain while simultaneously engaging in high-risk activities on another network.

According to the U.S. Department of the Treasury, illicit actors frequently use cross-chain bridges and multi-asset strategies to obscure fund trails, making integrated risk signal analysis across multiple blockchains essential for effective monitoring.

Regulatory Compliance and Reporting

Cryptocurrency risk signals help demonstrate control effectiveness to auditors and regulators by evidencing detection logic, escalation paths, and outcomes.

Under the Bank Secrecy Act, programs should show they can identify and act on patterns indicative of money laundering or terrorism financing. Strong programs typically maintain:

- Clear data lineage and model/rule documentation

- Consistent audit trails from alert to disposition

- Mapping to SAR decisioning requirements and timelines

- Evidence packs with wallet context, counterparties, and relevant on-chain traces

Reliable automation ensures consistent application of standards while allowing human review to focus on higher-value analysis.

Challenges and Considerations

Design programs to balance detection depth with efficiency:

- Calibrate thresholds to reduce noise while preserving meaningful detection coverage

- Maintain privacy-by-design practices that focus on necessary identifiers and purpose-limited use

- Continuously update coverage for new protocols, assets, transaction types, and privacy features

- Incorporate feedback loops from analyst dispositions to strengthen rules and models over time

Future Development and Enhancement

Risk signal technology continues evolving as blockchain ecosystems become more complex and illicit actors develop new evasion techniques. Machine learning algorithms increasingly supplement rule-based detection systems, enabling more sophisticated pattern recognition and adaptive threat detection.

Integration between traditional banking surveillance systems and blockchain investigation software will likely become more seamless, allowing risk signals from cryptocurrency transactions to inform broader customer risk assessments and compliance programs.

Law enforcement agencies are also developing more sophisticated capabilities for interpreting and acting upon cryptocurrency risk signals, improving coordination between financial institutions and investigative authorities.

Risk signals represent the critical foundation of effective cryptocurrency transaction monitoring, transforming complex blockchain data into actionable intelligence that enables both compliance and investigative success. As digital asset adoption continues expanding, robust risk signal capabilities will become increasingly essential for financial institutions and law enforcement agencies alike.

Whether you're implementing crypto compliance software for your institution, understanding how risk signals integrate into monitoring workflows is essential for program success. Schedule a consultation to discuss implementation strategies tailored for your compliance team.